Projects

BIONFIN - PROTECTING AND RESTORING BIODIVERSITY USING MAINSTREAM FINANCE Call: HORIZON-CL6-2023-BIODIV-01

2024-2027

Coordinator: John Garvey (University of Limerick)

Lusofona team leader: Francisco Silva Pinto

Partners

University of Limerick, Stichting Naturalis Biodiversity Center, Goeteborgs Universitet, the Queen's University of Belfast, Universiteit Maastricht, Rainno Idiotiki Kefalaiouchiki Etaireia, Sarajevska Regionalna Razvojna Agencija Serda Doo Sarajevo, Universita Degli Studi Di Padova, Etifor Srl, the Institute of Bankers in Ireland, Sustainability Literacy Test, International Life Sciences Institute European Branch.

Summary

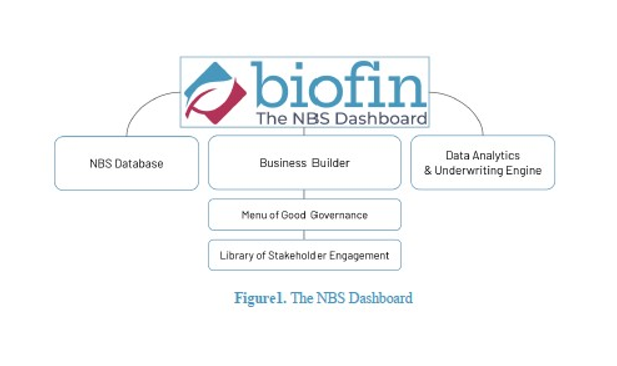

If biodiversity is to be placed back on a path to recovery, new tools and knowledge are required to redirect financial resources from destructive economic activity towards nature-positive investment. The financial system consists of interacting and dynamic actors who value certainty (rules and governance structures) and efficiency (outcome transparency and low monitoring costs). We aim to create a unifying framework and technology that creates the enabling conditions for nature-positive investments. Activities that protect and restore biodiversity (such as nature-based solutions) are frequently unique, multi-actor efforts carried out at a local scale with positive, but complex outcomes. We resolve this by establishing a categorisation of nature based solutions (NBS) alongside a menu of good governance structures and a library of stakeholder engagement. This will draw on expertise and best practice in natural capital and economics to streamline decision making and accelerate transaction completion by standardising the investment process and creating the enabling conditions for large-scale finance. To accelerate nature-positive business models, we create a data analytics and underwriting engine to advance conventional project appraisal and risk assessment and account for and model expected outcomes. We will assess and validate our approach across diverse real-life case studies (learning sites). Our findings and approach will initiate a twin green and digital transition that resolves transaction complexity and creates the enabling conditions for large-scale investment that are required if the EU is to achieve its biodiversity goals. Our outcomes will identify remaining gaps in the Taxonomy and support policy forming through evidence-based recommendations and we will co-design, develop and establish pathways for skills and knowledge accelerators for the European financial services industry.